hawaii capital gains tax exemptions

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. A short-term rate same as your income tax rate and b long-term rate for respective 2018 income brackets.

Why Raising Taxes On The Wealthy Hurts Everyone In Hawaii Grassroot Institute Of Hawaii

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022.

. Form N-289 Certification for Exemption from the Withholding of Tax on the. Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the. Gains from the transfer of land buildings or machinery from an urban area to a Special Economic Zone are exempt from taxation if the profit is reinvested to.

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. However the fact that an owner may be exempt from the HARPTA law does not also exempt the owner from paying state capital. Hawaii taxes both short- and long-term capital gains at a rate of 725.

HARPTA Hawaii Real Property Tax Act withholds 725 from any Non-Hawaii Resident or Entity who are selling with capital gains. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. The rate that the transfer is taxed at depends on its value.

Before you start to get anxious there are waivers that. Hawaii taxes both short- and long-term capital. Waives capital gains tax on investments made in Hawaii between 7101 and 63002 if the investment is held for more than two years.

Capital gains exclusions allow taxpayers to exclude a certain amount of profit from their taxable income as long as they have physically. This applies to all four factors of gain refer below for a discussion of the four factors. Those who earn 60000 or more are subject to a 7 capital gains tax rate in Hawaii.

Mar 01 2022 Under current law households can exempt from their capital gains taxes the first 250000 Single500000 Married of profits from the sale of a primary residence. A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for. The first one is universal to anyone who pays taxes.

However in March of 2021 a bill passed through the Senate that would raise capital gains tax rates to 11. You will be able to add more details like itemized deductions tax credits capital. A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for at least 2 years and 2 lived in the home as a primary residence.

You will pay either 0 15 or 20 in tax. 112 Capital gains tax. Generally only estates worth more than 5490000 must file an.

The difference between how much is withheld and. A short-term rate same as your income tax rate and b long-term rate for respective 2018 income brackets. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring.

Exhibit 2- 2018 shows marginal capital gains tax rates. Hawaii Capital Gains Tax. Capital gains are currently taxed at a rate of 725.

The Hawaii capital gains tax on real estate is 725. Some absentee owners are exempt from the HARPTA law. The Hawaii capital gains tax on real estate is 725.

In Hawaii non-resident sellers of real property are subject to a withholding referred to as HARPTA Hawaii Real Property Tax Act which amounts to 725 of the gross sales price. For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents. There is good news for Hawaii residents.

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Capital Gains Tax In Kentucky What You Need To Know

State Taxes On Capital Gains Center On Budget And Policy Priorities

1031 Exchange Hawaii Capital Gains Tax Rate 2022

State And Federal Tax Considerations On Ppp Loans Nfib

2021 2022 Long Term Capital Gains Tax Rates Bankrate

The Home Sale Tax Exemption Findlaw

Hawaii Income Tax Hi State Tax Calculator Community Tax

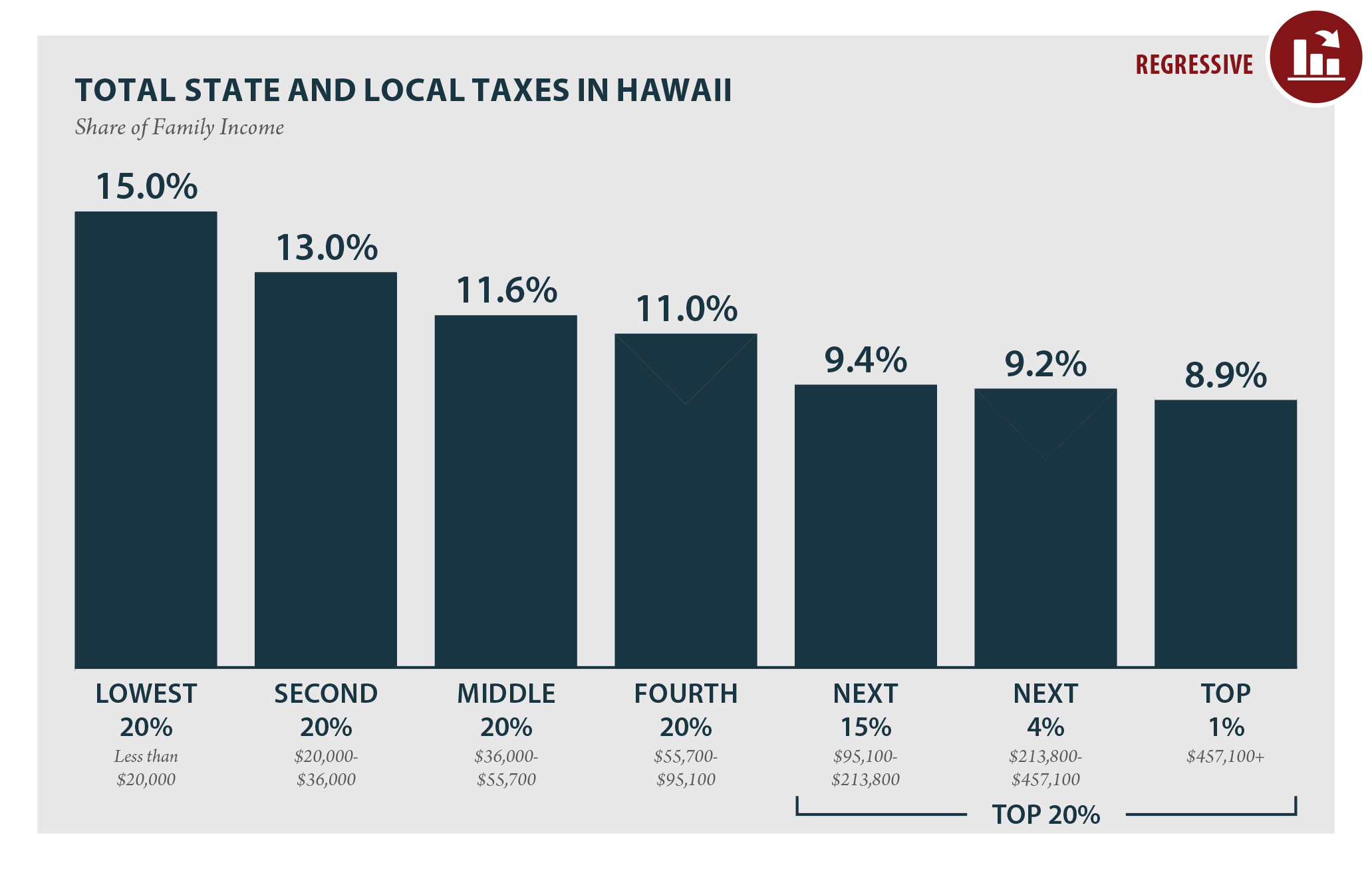

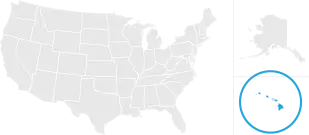

Hawaii Who Pays 6th Edition Itep

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Crypto Capital Gains And Tax Rates 2022

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How To Reduce Or Avoid Paying The Capital Gains Tax Legalmatch

States With The Highest Capital Gains Tax Rates

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses